What Is Diversification? Definition as Investing Strategy Leave a comment

Semiconductor manufacturers will be largely impacted, while the financial services sector might feel smaller, residual impacts. Amanda Bellucco-Chatham is an editor, writer, and fact-checker with years of experience researching personal finance topics. Specialties include general financial planning, career development, lending, retirement, tax preparation, and credit. Equity securities are subject to stock market fluctuations that occur in response to economic and business developments. Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Instead of hoping for favorable news specific to one company, positive news impacting one of dozens of companies may benefit your portfolio. There are several reasons why this is advantageous to investors. First, it may be too costly for retail investors to buy securities using different market orders. In addition, investors must then track their portfolio’s weight to ensure proper diversification. https://1investing.in/ Though an investor sacrifices a say in all of the underlying companies being invested in, they simply choose an easier investment approach that prioritizes minimizing risk. Consider the difference between short-term lease agreements for residential properties (i.e., up to one year) and long-term lease agreements for commercial properties (i.e., sometimes five years or greater).

Foreign Stocks

You can also invest in commodities, exchange-traded funds (ETFs), and real estate investment trusts (REITs). This way, you’ll spread your risk around, which can lead to bigger rewards. For investors seeking to minimize risk, diversification is a strong strategy. That said, diversification may minimize returns, as the goal of diversification is to reduce the risk within a portfolio. By reducing risk, an investor is willing to take less profit in exchange for the preservation of capital. By spreading your investment across different asset classes, industries, or maturities, you are less likely to experience market shocks that impact every single one of your investments the same.

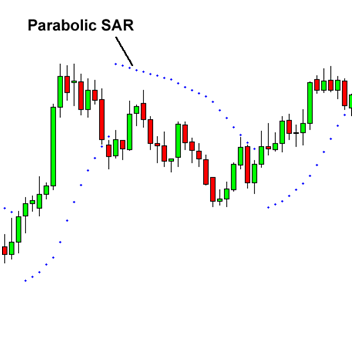

With the luxury of hindsight, we can sit back and critique the gyrations and reactions of the markets as they began to stumble during the dotcom crash, the Great Recession, and again during the COVID-19 recession. Read on to find out why diversification is important for your portfolio, and five tips to help you make smart choices. Gordon Scott has been an active investor and technical analyst or 20+ years. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index (Market Barometer) quotes are real-time.

It will ask you a series of questions with various market scenarios. This can help you decide which mutual funds best fit your goals. Your objective will dictate what asset classes and security types you should have to meet the purpose of your portfolio. Understanding the diversification benefits may help you create a more diversified portfolio with higher and lower risk investments to help you reach your goals. Long-term asset classes typically yield a higher return (there’s never a guarantee), but they also have higher risks. Conversely, short-term assets have much lower risk, but also lower rewards.

Foreign Fixed Income

They can also act as a cushion against the unpredictable ups and downs of the stock market, as they often behave differently than stocks. Investors who are more focused on safety than growth often favor US Treasury or other high-quality bonds, while reducing their exposure to stocks. These investors may have to accept lower long-term returns, as many bonds—especially high-quality issues—generally don’t offer returns as high as stocks over the long term. However, note that some fixed income investments, like high-yield bonds and certain international bonds, can offer much higher yields, albeit with more risk. Diversification, however, also can have a negative impact on portfolio returns. When investors use diversification, they do not have a significant concentration in any one investment or industry sector in an attempt to capture idiosyncratic high returns.

In this, they create a portfolio with assets like stocks, bonds, and commodities. A good example of such investors is Ray Dalio, who runs the biggest hedge fund in the world. Diversification is a common investing technique carshop used to reduce your chances of experiencing large losses. By spreading your investments across different assets, you’re less likely to have your portfolio wiped out due to one negative event impacting that single holding.

How Can Diversification Help Reduce the Impact of Market Volatility?

Also, with different correlations, or responses to outside forces, among the securities, they can slightly lessen their risk exposure. Financial instruments such as stocks and bonds are intangible investments; they can not be physically touched or felt. On the other hand, tangible investments such as land, real estate, farmland, precious metals, or commodities can be touched and have real-world applications. These real assets have different investment profiles as they can be consumed, rented, developed, or treated differently than intangible or digital assets.

If you focus on one investment in one industry, you put almost everything at risk. Say, for example, you invested only in tech stocks like Facebook. What happens when Facebook is in hot water and its stock falls? When you diversify, you put your investment dollars in different investments with different returns. Some investors believe that the best way to make more money in the market is to buy and hold a handful of companies. A good example of such an investor is Bill Ackman, who manages more than $8 billion in assets.

With dollar-cost averaging, you invest money on a regular basis into a specified portfolio of securities. Using this strategy, you’ll buy more shares when prices are low, and fewer when prices are high. When the market is booming, it seems almost impossible to sell a stock for any amount less than the price at which you bought it. However, since we can never be sure of what the market will do at any moment, we cannot forget the importance of a well-diversified portfolio in any market condition.

Consider Index or Bond Funds

The companies within an industry have similar risks, so a portfolio needs a broad swath of industries. Remember, to reduce company-specific risk, portfolios have to vary by company industry, size and geography. One of the keys to a diversified portfolio is owning a wide variety of different stocks.

- If you’re familiar with the proverb “Don’t put all your eggs in one basket,” you have a basic understanding of diversification in investing.

- It is important to notice that within portfolio management practices there’s a distinction between naive diversification and effective diversification (also referred to as optimal diversification).

- Because cash is generally used as a short-term reserve, most investors develop an asset allocation strategy for their portfolios based primarily on the use of stocks and bonds.

- This portfolio is likely to produce average returns of 5% to 8% in the long term, based on historical averages.

- All investments carry some level of risk including the potential loss of all money invested.

Logically, that means you’re going to own some asset classes that don’t perform well — sometimes, for quite some time. You’ll want a mix of bonds issued by corporations, states and municipalities (or “munis”) and the federal government (“Treasuries”), all of which have different risk levels and expected returns. Corporate bonds have the greatest potential returns—and the greatest risks. Since Treasuries are backed by the U.S. government, they’re considered relatively low risk. Every company gets labeled according to what its business does. Other sectors include financials, consumer staples, health care and real estate.

The places you choose to invest in are important, but your behavior plays an equally important role in building wealth over the long term. An advisor can help you see through the noise and stay focused on the big picture. Not only can they build out a diversified portfolio that’s tailored to you or your goals, their objective perspective and experience can help instill confidence to stick with your plan through thick and thin. You’ll be equipped with a plan with a range of financial options that gives you flexibility today and in the future. Diversification and asset allocation do not guarantee a profit, nor do they eliminate the risk of loss of principal. Companies selected for inclusion in the portfolio may not exhibit positive or favorable ESG characteristics at all times and may shift into and out of favor depending on market and economic conditions.

Instead, if you diversify your investments, you create a balanced portfolio with different investments that react differently to market volatility rather than focusing on one asset class. If you didn’t diversify, you’d either risk your entire investment if you put everything in stocks or have minimal returns if you put everything in bonds or other fixed-income securities. Some investors believe in having a diversified portfolio of large-cap value companies like Proctor & Gamble, Unilever, and AT&T. Others believe in having a mixed portfolio that combines small caps, mid-caps, growth companies, and dividend companies.

Diversification

Buying individual stocks takes time and energy, especially if you want a properly diversified portfolio. A better option is going for low-cost mutual funds and exchange traded funds (ETF), which give you a basket of investments through a single purchase order. Investing involves risks, including the potential loss of principal. The stock prices of midsize and small companies can change more frequently and dramatically than those of large companies.

How to Invest in Platinum Stocks – Money

How to Invest in Platinum Stocks.

Posted: Wed, 13 Sep 2023 13:54:15 GMT [source]

The primary purpose of permanent life insurance is to provide a death benefit. Using cash values through policy loans, surrenders, or cash withdrawals will reduce benefits and may affect other aspects of your plan. All guarantees are backed solely by the claims-paying ability of the insurer.

This is a risky approach because if Apple stock prices were to slump due to unforeseen circumstances, your whole investment portfolio would suffer the consequences. You might diversify within the technology sector by investing in other tech stocks, but if the whole technology sector is negatively impacted, your portfolio would still take a big hit. Non-stock diversification options include bonds, bank CDs, gold, cryptocurrencies, and real estate. In theory, holding investments that are different from each other reduces the overall risk of the assets you’re invested in.